4 Signals Suggest Bitcoin’s Downtrend May Not Be Over Yet

Bitcoin (BTC) has fallen 23.4% so far this year, after declining more than 6% in 2025. Prices have remained under sustained pressure, with the leading cryptocurrency currently trading at $67,214.

Amid this, a key question continues to weigh on market sentiment: when will the Bitcoin downtrend end? Four key signals suggest that the asset may still be in the early stages of a bear market, raising the possibility of further downside.

Sponsored

Sponsored

Capital Flight Confirms Bearish Sentiment Shift

Investor flow data sends the first warning sign. CryptoQuant data showed new investor inflows have turned negative. An analyst said this indicates the ongoing sell-off is not being absorbed by new capital entering the market.

The analyst explained that in bull markets, capital tends to accelerate during price drawdowns, as investors treat dips as buying opportunities. In contrast, the early stages of bear markets are often marked by capital withdrawal amid weakness.

“Current readings resemble post-ATH transitions, in which marginal buyers exit and price is driven by internal rotation, not net inflows. Without renewed inflows, upside moves remain corrective. This behavior is consistent with early bear market conditions: contracting liquidity and narrowing participation,” the analyst added.

Technical Pattern Signals Room for Another Leg Lower in Bitcoin

Crypto analyst Jelle pointed to historical cycle data to frame the current downside risk. He explained that in previous major bear markets, price bottomed below the 0.618 Fibonacci retracement measured from the prior cycle peak.

The earliest cycle saw a significantly deeper move, with Bitcoin falling roughly 64% beyond the 0.618 level. In later cycles, however, the depth of those breakdowns moderated.

Sponsored

Sponsored

The most recent bear market bottom formed about 45% below that retracement threshold, reflecting a pattern of progressively shallower declines.

“0.618 from the current cycle high sits at $57,000. If Bitcoin bottoms just 30% below the 0.618 retracement this time around, we’re still looking at $42,000,” the analyst remarked.

This suggests the price may fall further. Additionally, other experts have previously forecasted that Bitcoin could find a bottom even below $40,000.

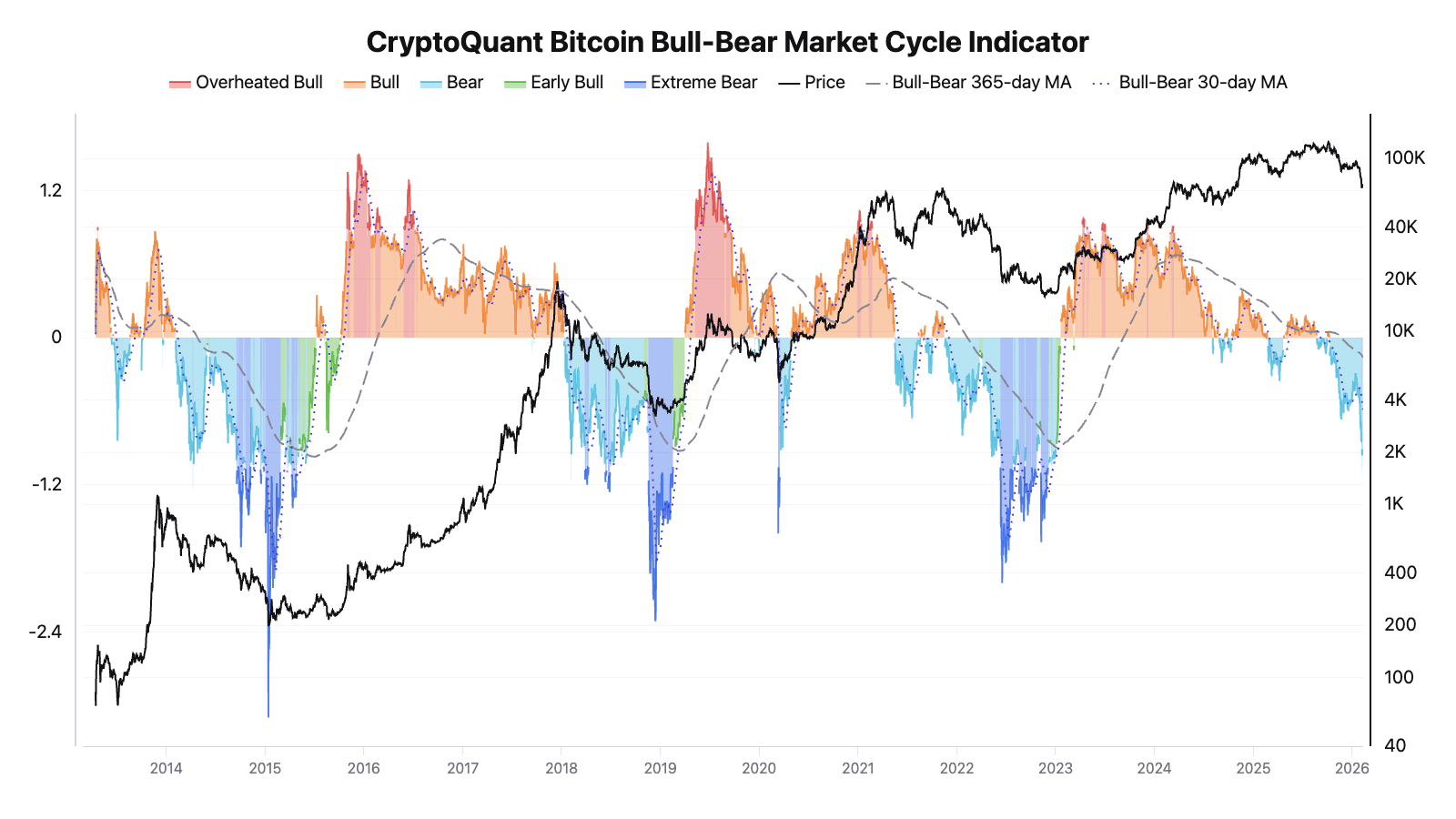

Market Cycle Indicator Points to Further Downside Risk

In addition, the Bull-Bear Market Cycle Indicator, which tracks broader market phases, signals that bearish conditions began in October 2025. However, the metric has not yet entered what is typically classified as an extreme bear phase.

Sponsored

Sponsored

In previous cycles, the indicator has moved into the dark-blue zone, suggesting that lower levels may still lie ahead.

Whales Stack BTC, Yet Recovery May Take Time

Finally, on-chain data shows that Bitcoin whales have been accumulating during the recent dip, as exchange outflows continue to rise. The 30-day simple moving average of exchange outflows has climbed to 3.2%.

Sponsored

Sponsored

This pattern closely mirrors the first half of 2022. Although whale accumulation is often interpreted as a constructive signal, history suggests caution. In the previous cycle, a broader recovery did not materialize until early 2023.

The similarity in structure suggests that while smart money may be positioning, it does not necessarily mean an immediate rebound is imminent. Instead, the data implies that the market could remain under pressure in the near term, even as long-term holders continue to build exposure.

Separately, Kaiko analysis suggested that Bitcoin still appears to be tracking its traditional four-year cycle. Based on that framework, the firm stated,

“The four-year cycle framework predicts we should be at the 30% mark.”

Taken together, these four indicators point to the possibility that Bitcoin could remain under pressure. However, when the bear market will end remains a point of division among experts.

Ray Youssef, CEO of NoOnes, said it is unlikely that Bitcoin will see a V-shaped recovery before the summer of 2026. Julio Moreno, Head of Research at CryptoQuant, has also suggested that the current bearish phase could end in Q3 2026.

In contrast, Bitwise CIO Matt Hougan has expressed a more optimistic view, indicating that the end of the crypto winter could be approaching.