CME XRP futures hit $542 million volume in first month, strengthening case for spot XRP ETFs

Key Takeaways

- CME XRP futures reached $542 million in trading volume within their first month, showing strong institutional and retail demand.

- Nearly half of the XRP futures trading volume comes from outside North America, highlighting growing global interest.

Share this article

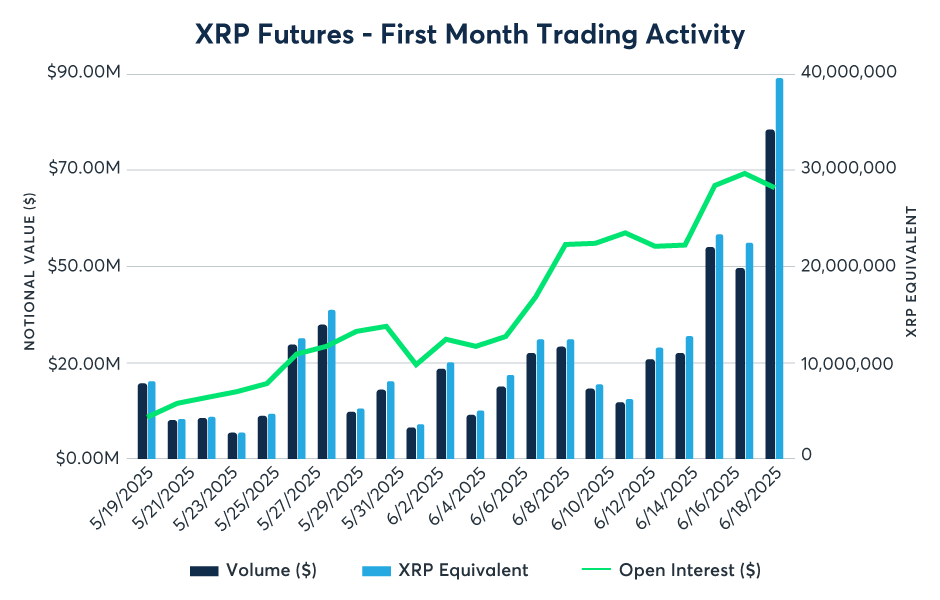

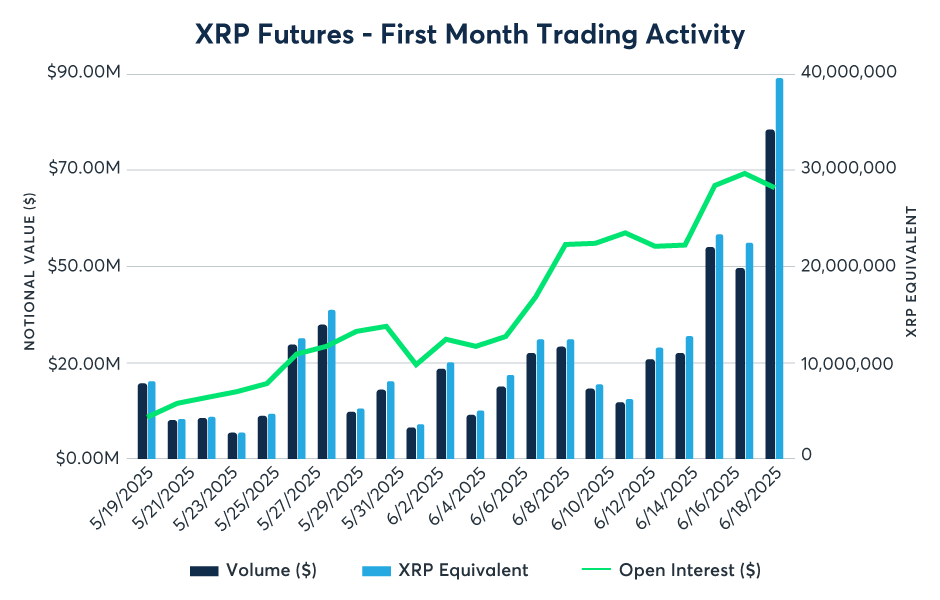

CME Group’s XRP futures and Micro XRP futures have recorded $542 million in total trading volume since their launch on May 19, according to a new report from the leading derivatives marketplace.

Since launching on May 19, XRP and Micro XRP futures have shown demand across institutional and retail participants, highlighting interest in regulated tools to access one of the most watched crypto assets.

Get the full breakdown ➡️ https://t.co/nmVRaXqUTO pic.twitter.com/JZG2Bnnjll

— CME Group (@CMEGroup) June 24, 2025

These XRP products got off to a strong start with $19 million in launch-day trading, but interest quickly accelerated as volume jumped 28 times over the first month.

Global adoption is also growing, with nearly half of the activity coming from outside the US and Canada, the report notes.

CME Group announced the launch of its XRP products in April, targeting to expand its existing crypto derivatives lineup, which already features contracts tied to Bitcoin, Ethereum, and Solana. CME’s Solana futures went live in March.

These contracts are available in both standard (50,000 XRP) and micro (2,500 XRP) sizes, are cash-settled, and reference the CME CF XRP-Dollar Reference Rate.

In addition to CME Group, major exchanges like Coinbase Derivatives and Bitnomial have received regulatory approval to offer XRP futures contracts in the US. These offerings were rolled out after the SEC agreed to withdraw its appeal in the Ripple Labs case.

The existence of CFTC-regulated futures is one of the most influential factors in the SEC’s evaluation of spot crypto ETF applications.

The SEC has previously cited the presence of a regulated futures market as a key requirement for approving spot Bitcoin and Ethereum ETFs. Analysts and legal experts note that this precedent now applies to XRP, as CFTC-regulated XRP futures are live on major platforms like CME Group, Coinbase Derivatives, and Bitnomial.

XRP has joined Litecoin and Solana in the top tier for ETF approval, as experts see a 95% likelihood of the SEC approving a spot ETF linked to Ripple’s flagship crypto asset.

Share this article